The Great Shift in Biotech R&D

In the new global triangle, China leads R&D, US preserves its high-margin market dominance, and India is the affordable-access engine. The triangle is forming. What are we doing?

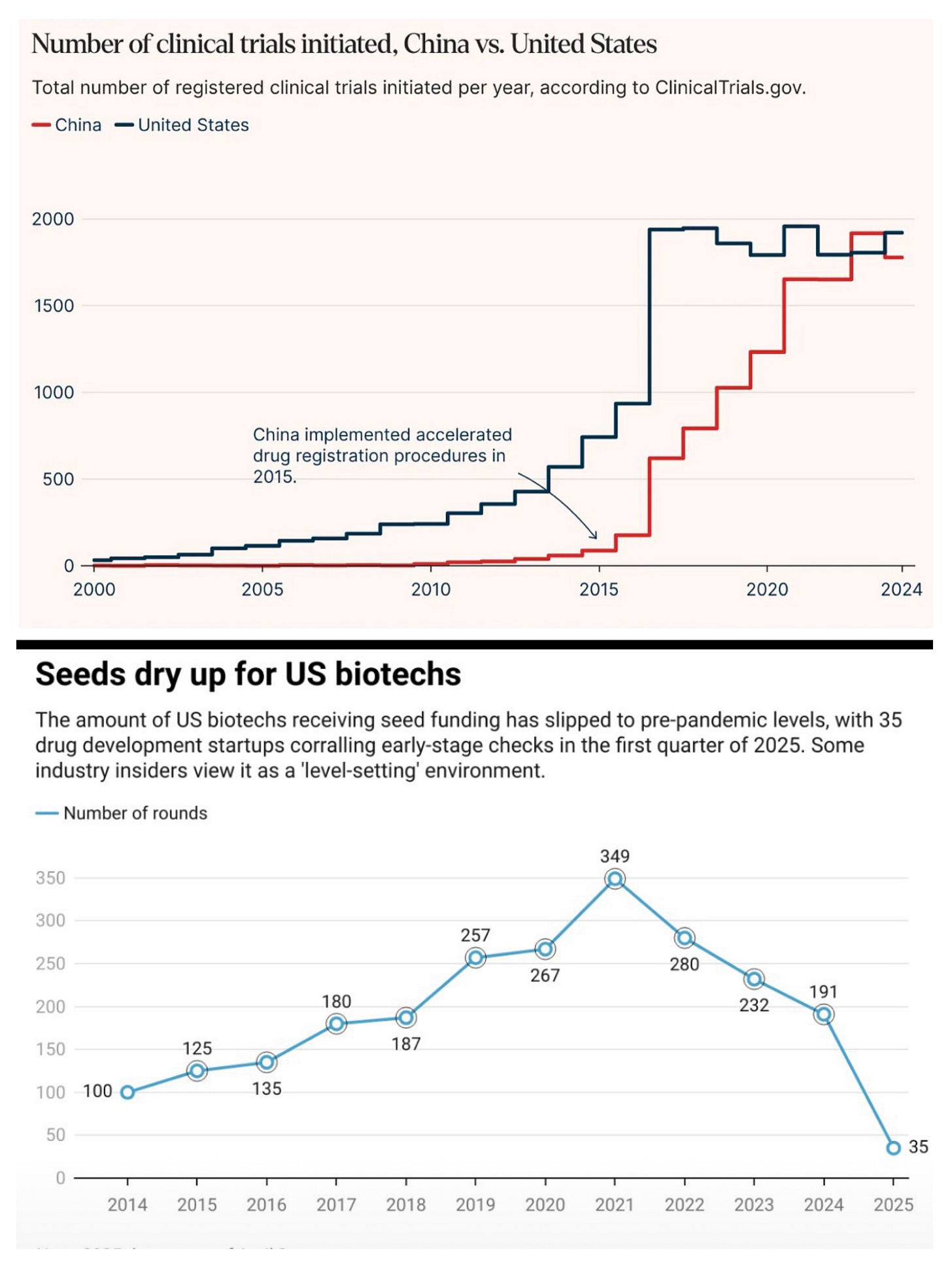

Look at these two charts. They demonstrate (anecdotally) the great shift happening in global biopharma R&D. For decades, the United States had stood unchallenged at the helm of global biotech innovation, its dominance built on deep capital markets, world-class academic institutions, a robust regulatory framework, and abundant venture capital. But signs are emerging that this monopoly on innovation is beginning to fragment. As US investments into biotech R&D taper off, a quiet but powerful redirection of innovation capital is unfolding — toward China.

US biotech firms, long reliant on aggressive funding cycles, are now struggling with rising interest rates, weaker IPO windows, and an increasingly conservative investor mindset. R&D budgets are being slashed or redirected toward near-term commercial programs rather than high-risk discovery projects. Many once-promising early-stage biotechs are now shelving their pipelines or seeking partnerships — increasingly outside of traditional Western strongholds.

China, by contrast, has strategically positioned itself as the next engine of biotech growth. A combination of government support, homegrown talent returning from Western markets, and strong private investment has made Chinese biotech startups not only viable but vibrant. While US companies once viewed Chinese biotechs as CROs or manufacturing hubs, they now view them as peers — and sometimes leaders — in cutting-edge science.

More tellingly, MNCs have started licensing drug candidates from Chinese biotechs. AZ, Merck, and BMS have all inked deals with Chinese firms in areas ranging from oncology to immunotherapy. The shift is no longer a forecast; it is happening in real time.

Meanwhile, Europe has had a quiet exit, becoming increasingly peripheral in this new biotech world order. Risk-averse regulatory frameworks, modest public funding, and a fragmented commercial landscape have pushed biotech innovation out of the continent. While notable hubs like Switzerland and the UK still contribute, their global relevance is fading compared to the scale and speed emerging from China.

With innovation shifting to China, the economics of biotech are being rewritten. Chinese companies operate with far lower R&D costs, and yet produce globally competitive therapies. As a result, the floor price for innovative therapies is dropping — a trend that will not go unnoticed in emerging markets. If a Chinese-origin immunotherapy can be brought to market at one-third the price of its US counterpart, it opens the floodgates for access — not just in China but across Asia, Africa, and Latin America.

This creates a profound conundrum for Western regulators: do they block Chinese-origin therapies over national security or quality concerns, or allow them in and risk upsetting the delicate pricing dynamics of US pharma? Kind of explains why RFK Jr is needed, and is doing what he is, doesn't it?

This shift is a massive opportunity for Indian generics companies — but only if they act decisively. And that is a huge IF.

The historic model of high-volume, low-margin generic manufacturing is under stress. Price erosion in the US market and regulatory tightening are forcing Indian players to rethink their portfolios. The Chinese biotech pipeline could offer them a strategic reset.

What could this look like?

Indian firms can in-license with Chinese biotechs. They can co-manufacture and seek tech transfer which is likely to cause a therapeutic focus shift, moving from primary care and antibiotics toward biologics, orphan drugs, and biosimilars with Chinese origin IP.

So far, Sun Pharma is one of the few Indian companies meaningfully engaging with specialty portfolios and niche markets. The rest of the Indian industry, however, remains locked in a generics mindset, focused on mature molecules, older therapies, and largely Western markets.

Here lies the critical question. If Indian companies continue chasing high-margin markets in the West, little will change for access in emerging economies. But if they embrace the China-led pricing disruption, they could redefine global access to new medicines.

This requires a mindset shift — from chasing margins to building volume-based value. With the right licensing models, innovative Chinese therapies could be made affordable in Africa, Southeast Asia, and Latin America through Indian scale and supply chains.

But for this to happen, Indian companies must invest in regulatory capabilities to handle complex biologics and niche therapies, create cross-border innovation hubs that link China’s R&D with India’s manufacturing muscle and engage more deeply in pharmacoeconomics to prove the value of access-based models in large underserved populations. Given the geopolitical tensions, this will not be easy, but it isn't impossible either.

We might be witnessing the birth of a new global triangle in healthcare innovation — with China leading R&D, the US preserving its high-margin market dominance, and countries like India potentially playing the role of the affordable access engine. The question is not whether Indian companies can step into this role, but whether they will.

The moment is ripe. The global pricing floor is shifting. Innovation is migrating. If Indian pharma chooses evolution over inertia, it could define the next frontier in global healthcare equity. Because if it does not, others will.